THE CONSEQUENCES OF EIHA’s ISOLATE TOXICOLOGY SUBMISSION FOR MEMBER BRANDS IN THE UK

This week alerted the wider CBD market to some old issues which we had been repeatedly raising with participants who were either already subscribed to the EIHA application or were the recipients of invitations to join the application, plus a considerable new issue around the EIHA Toxicology Consortium results.

THE END PRODUCTS TO BE COVERED BY THE EIHA APPLICATION WERE ALWAYS INCREDIBLY LIMITED

The old issue was that a procession of EIHA members and potential members who had received various “talks” from key stakeholders within EIHA sought our opinion of their applications likely future progress and appeared to be completely surprised when we told them that the EIHA CBD Isolate (RP 427) and full spectrum/distillate applications (RP 438) were only ever going to cover an incredibly limited number of products.

Many months ago we saw EIHA documentation which indicated that the only products to be covered by the EIHA applications (and the respective toxicology submissions which would support each of them) were Hemp Oil Tinctures at a strength no greater than 10%, but in discussions with a large number of market participants (many of whom are full fee-paying members of EIHA and the Toxicology Consortium), it appeared that they were completely unaware of these significant restrictions, many believing that they had been told by EIHA and its lead members that there were no restrictions at all.

This got us thinking: how could all of these separate, independent and unconnected companies, comprising of multiple people within each, all be wrong and be making the exact same mistake as each other in failing to comprehend that which we expect EIHA would have been explaining to them in very clear terms? We came to two potential conclusions:

(a) each group were individually and collectively failing to understand what EIHA had been explaining to them before taking their money (and they just happened to be independently misinterpreting, in the same way as other similar groups, who were misunderstanding the same information in exactly the same way); or,

(b) each group were not misunderstanding at all and no-one had bothered to explain to them the constraints with which they were choosing to voluntarily handcuff themselves in the run-up to being asked to part with their money for their EIHA membership fees and Toxicology Consortium subscriptions.

THE SAFETY CONTRAINTS DEMANDED BY RESULTS OF EIHA’s TOXICOLOGY CONSORTIUM STUDY RESTRICT THE END PRODUCTS EVEN FURTHER

CONTRADICTIONS AND U-TURNS – WHO KNEW WHAT AND WHEN?

EIHA has now informed its members that the maximum daily intake for which safety can be established is now to be 17.5mg CBD, representing a 400% reduction in that presently quoted by the UK Food Standards Agency and that which was advocated by EIHA. On 9th November 2022 Lorenza Romanese, EIHA’s Managing Director explained to BusinessCann (emphasis added):

For the isolate CBD we observed effects in four organs, including the liver and the kidney. Therefore, the derived NOAEL (non-observable adverse effect level) is lower than we initially expected and lower than what is indicated in the existing literature. This led us to infer an Acceptable Daily Intake (ADI) of 17.5 per day of CBD, which has been proposed to EFSA and FSA.

For those of you who have not followed the position as closely as others, this could not be in greater contradiction to what the same Lorenza Romanese told the same BusinessCann in April of this year about the outcome of the completed isolate CBD toxicology studies and of the maximum safe amount. The article remains live and so it not been the subject of any challenge as to its accuracy (emphasis added):

When it comes to isolate CBD, the 90 day studies have been completed. We are now drafting the report to be submitted to the FSA, so I expect the submission on this at the latest July this year. When it comes to full spectrum, the results will come by the end of the year, when it comes to THC on human being, the results will come in 2023.

So all the studies both for isolate and full spectrum CBD are concluded. And so far, I can simply say that there is nothing to worry about. There were no values beyond or even near to the limit. So this product, according to the level that we have tested, can be considered safe.

When what we have been seeing is that all the text tests were negative, which in toxicology is very good because it means that there is no adverse effect for the parameters that we have been testing at the level that we have been testing.

It is perhaps fortunate that EIHA is not a Public Company in the UK because s89(1) of the Financial Services Act 2012 makes it a criminal offence for a person to either:

- make a statement which he knows to be false or misleading in a material respect; or

- make a statement which is false or misleading in a material respect, being reckless as to whether it is; or

- dishonestly conceal any material facts whether in connection with a statement made by that person or otherwise.

“MEMBERS WERE TOLD MANY MONTHS AGO”

We understand that EIHA are again adamant that they have been telling their membership of the 4-fold reduction (in the ingestion rate to accommodate the new safety parameters from the study completed in April 2022) for many months and that it must be the membership who failed to listen. It would seem that the member companies that have been approaching us this week must not have been paying attention because they certainly don’t recall being told about it – something which they find strange because they believe that they would recall being told about a change that will decimate their product lines and businesses.

REGULATORY CONSEQUENCES MUST SURELY FOLLOW

As the regulator in the UK, the Food Standards Agency has thus far been in a position that it did not know what the maximum safe level of CBD ingestion was, so followed the Committee on Toxicity (CoT) interim recommendation of 70mg per adult per day.

Now, however, following EIHA’s submission of the Toxicology data it is overtly aware that the Applicant itself asserts that safety of the isolate CBD which is the subject of application RP 427 cannot be established above 17.5mg per day – it is an open declaration to the regulator which the regulator, in our opinion, cannot simply ignore.

In our view, this now means that the specification of every product which is included within the UK FSA Public List of CBD Products and which is linked to Dossier RP 427 must now be reconsidered by the FSA for the suitability of its continued inclusion in that Public List because the toxicology data and Dossier as submitted do not (and never will) support the vast majority of them. We suggest that to do anything else risks the regulator being complicit in the exposure of the population to products which are not only unlawful per se, but in respect of which the Applicant openly acknowledges that it cannot establish a safety case for usage in excess of 17.5mg per day and for no longer than six months.

WHAT ARE THE CONSEQUENCES FOR THE PRODUCTS WHICH ARE THE SUBJECT OF APPLICATION RP 427, MANY OF WHICH ARE ON THE PUBLIC LIST?

We have taken some time to review the public information about RP 427 as gleaned from the UK FSA Public List: for the Brands involved there are some chilling consequences.

We have analysed the products and categorised them as follows:

- Oils/Tinctures;

- Gummies;

- Capsules;

- Chocolates;

- Edibles other than 2-4;

- Coffee;

- Tea; and,

- Cold Drinks.

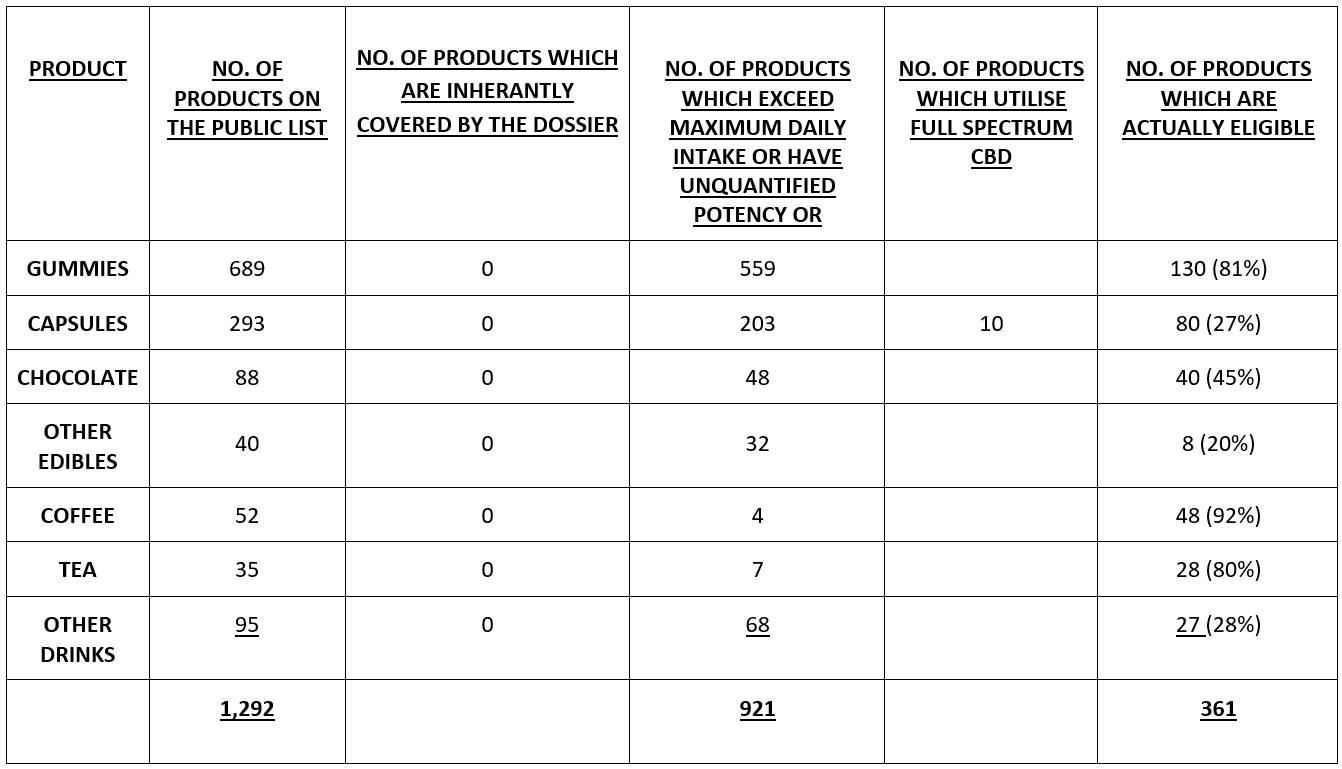

A table which summarises the following text is included at the end of the document.

THE OVERALL NUMBER OF PRODUCTS AND THE REDUNDANCY/FAILURE RATE

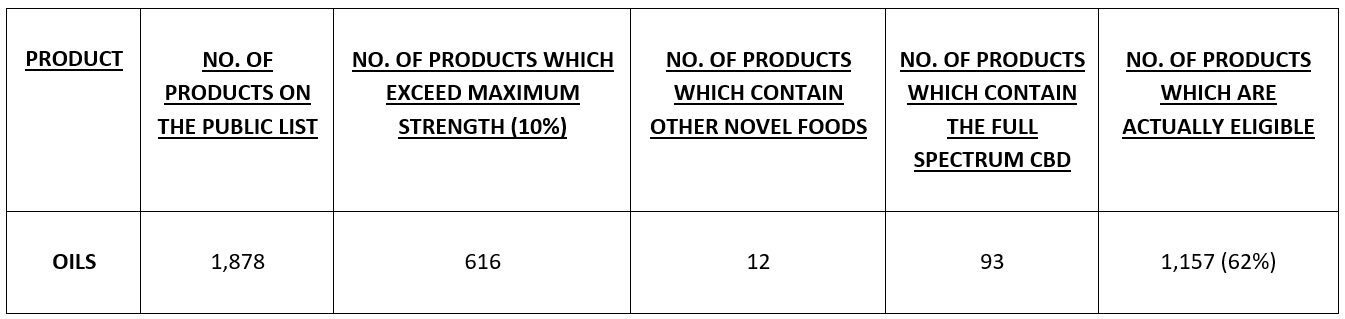

There are 3,224 products on the Public List, but when one removes the 54 which relate to raw ingredients and are not consumer-facing End Products, this falls to 3,170 separate entries.

- Of those 3,170 products, the only category of products which is capable of being covered by the EIHA’s application are oils/tinctures, which number 1,878 in total.

- However:

- 616 of the 1,878 are at a strength exceeding 10% and 4 are unquantified and so the eligibility figure is reduced to 1,262;

- 12 of the 1,262 contain other ingredients which are Novel Foods in themselves and will not be considered as part of the EIHA submission, bringing the figure down to 1,250;

- the 1,250 includes 93 products which are bound to failure because they are Full Spectrum products (not Isolate-based), reducing the figure to 1,157 (62%);

Therefore, of the 3,224 products on the list, the EIHA application is only suitable (and was only ever suitable) for 1,157 of them – a 36% eligibility rate and a redundancy/failure rate of 64%. This means that the toxicology and Dossiers costs of the eligible products have been subsidized 2 to 1 by the two-thirds of products who could never have benefitted in any way.

The first question that arises in our mind is just how much money the owners of those 2,009 products have paid to EIHA:

(a) from the outset for the 1,292 products which were never suitable for inclusion in the EIHA application?

(b) since the date upon which EIHA knew that the results of the isolate toxicology study required a 400% reduction in the daily ingestion level and were not as they publicly represented to the market in April 2022 (and ever since)?

It is important to stress that what follows is a theoretical assessment of the non-oil products. It is theoretical because no product other than a Hemp Oil product (or “other food grade oil” as EIHA now appear to state) with a maximum 10% CBD isolate content has been applied for under the EIHA application RP 427.

IF ONE IGNORES THE “ONLY OILS NEED APPLY” LIMITATION IMPOSED BY EIHA AND SEEKS TO INCLUDE PRODUCTS OTHER THAN OILS BUT SUBSEQURNTLY APPLIES THE 17.5mg MAXIMUM DAILY INTAKE, WHAT IS THE REDUNDANCY/FAILURE RATE?

GUMMIES

There are 689 Gummy products on the Public List, all of which are bound to failure because only oils are covered by the Dossier.

If Gummies were within the submission, then 555 of the 689 Gummy products would fail because they would not be within the safety assessment criteria because a single Gummy would exceed the 17.5mg maximum intake, with a further 4 of unquantified potency. This is an eligibility rate of only 19% (130 products) and a failure/redundancy rate of a whopping 81%.

CAPSULES

There are 293 Capsule products on the Public List, all of which are bound to failure because only oils are covered by the Dossier (notwithstanding that these capsules may contain oil-based CBD, they will inevitably metabolize differently within the body and will therefore require different toxicological and ADME assessments).

If Capsules were within the submission, then 200 of the products would fail because they would not be within the safety assessment criteria because a single Gummy would exceed the 17.5mg maximum intake, with a further 3 of unquantified potency. In addition, of those 90 products which are in principle eligible, another 10 must be removed because they are made with Full Spectrum CBD rather than isolated CBD. This creates an eligibility figure of 80 products from the original 203, an eligibility rate of only 27% and a failure/redundancy rate of a not inconsiderable 72%.

CHOCOLATE

There are 88 Chocolate products on the Public List, all of which are bound to failure because only oils are covered by the Dossier (notwithstanding that these capsules may contain oil-based CBD, they will inevitably metabolize differently within the body and will therefore require different toxicological and ADME assessments).

If Chocolate was within the submission, then 46 of the 88 Chocolate products would fail because they would not be within the safety assessment criteria because a unit of the Chocolate would exceed the 17.5mg maximum intake, with an additional 2 having an unquantified strength. This is an eligibility rate of only 45% (40 products) and a failure/redundancy rate of over half at 55%.

OTHER EDIBLES

There are 40 Other Edible products on the Public List, all of which are bound to failure because only oils are covered by the Dossier (notwithstanding that these capsules may contain oil-based CBD, they will inevitably metabolize differently within the body and will therefore require different toxicological and ADME assessments).

If Other Edible were within the submission, then 14 of the 40 Other Edible products would fail because they would not be within the safety assessment criteria because a single unit of the Other Edible would exceed the 17.5mg maximum intake. The data provided in respect of 18 products is insufficient to ascertain the minimum delivery dosage, leaving only 8 products which are within the required 17.5mg tolerance. This is an eligibility rate of only 20% (8 products) and a failure/redundancy rate of over half, at 80% (potentially skewed because of the inadequate information).

COFFEE

There are 52 Coffee products on the Public List, all of which are bound to failure because only oils are covered by the Dossier.

If Coffee was within the submission then 1 of the 52 Coffee products would fail because it would not be within the safety assessment criteria because a unit of the Coffee would exceed the 17.5mg maximum intake. The data provided in respect of 3 products (6%) is insufficient to ascertain the minimum delivery dosage. This is an eligibility rate of 92% (48 products) and a failure/redundancy rate of only 8%.

TEA

There are 35 Tea products on the Public List, all of which are bound to failure because only oils are covered by the Dossier.

If Tea was within the submission then 28 of the Tea products would be within the safety assessment criteria of 17.5mg maximum intake. The data provided in respect of 7 products (20%) is insufficient to ascertain the minimum delivery dosage. This is an eligibility rate of 80% (28 products) and a failure/redundancy rate of zero.

OTHER DRINKS

There are 95 Other Drink products on the Public List, all of which are bound to failure because only oils are covered by the Dossier.

If these Other Drinks were within the submission then 48 of the 95 products would fail because they would not be within the safety assessment criteria because a serving unit would exceed the 17.5mg maximum intake. The data provided in respect of 20 products (21%) is insufficient to ascertain the minimum delivery dosage. This is an eligibility rate of 28% (27 products) and a failure/redundancy rate of just over half at 51%.

BRANDS NEGATIVELY IMPACTED BY THE CHANGING EIHA POSITION

We have undertaken this theoretical task to inform readers so that, if there are those who will seek to persuade you that products other than oils can/will be added to the Dossier in due course, remember the nature and accuracy (or otherwise) of statements that have been made to you thus far and consider whether, even if a product of “X” nature were to be added (despite the rules saying that it can’t be), will your “X” product qualify in any event?

Any potential recourse must be based on the regulator understanding the steps taken by the brand to achieve compliance and implore the regulator to take a proportionate approach for either the reformulation of the unsupported products (if they remain on the EIHA dossiers) or the ability to move to another dossier (which may have to wait until EIHA disclose the details of their study and it can be examined against submitted studies which do not reach the same conclusions). Unfortunately, both these options are unlikely.

IT IS NOT ONLY RP 427 THAT IS AFFECTED – RP 438 WILL BE IMPACTED IN A SIMILAR MANNER

The issues raised within this document concerning the applicability of the submitted Dossier to the products of the Brands who have paid for its submission and who continue to pay fees to EIHA in order to be able to “benefit” (which is dubious in itself) from the Dossier, are not limited to the isolate application that is RP 427.

The same issues and failings will apply equally to the EIHA distillate application which is RP 438. It would appear that there are 1,915 products which are on the UK FSA Public List allied to that application. Given the failure rate within RP 427, as identified above, there will be a lot of nervous Brands out there – if the same 64% failure rate was applied to RP 438 then 1,226 of those 1,915 products will not be covered by the application. If you are anything other than an oil product that does not exceed 10%, then you need to consider the reality and start ensuring that you are asking the right questions of EIHA – whether you receive an answer that is worth anything is a different matter altogether.

At The Canna Consultants we do not relish bringing market participants bad news, but we do pride ourselves on being frank and open with the market, delivering accurate information and challenging misleading statements and conduct by anyone, particularly those who claim to be “Leaders” in the Cannabinoid Industry.

It is perhaps noticeable that the four other entities which claim to speak for the entirety of the industry – the Cannabis Trades Association (CTA), the Cannabis Industry Council (CIC), the Association for the Cannabinoid Industry (ACI) and the Advisors to the Secretariat to the APPG (ASAPPG) appear to have been conspicuously silent.

Why would they stay silent on an issue so fundamental to the Brands who believed that they were making regulatory progress through their membership of the EIHA application, and whose own members will be impacted by the FSA/EFSA reaction to the adverse toxicology results submitted by EIHA? Here is perhaps some food for thought:

- the CTA directed members towards the EIHA application and encouraged them to join it (such is their animous to the ACI), and so may be rather bashful about explaining why it did not see the car crash coming;

- the CIC is a member of EIHA and so may be rather bashful about explaining why it did not see the car crash coming;

- the ACI (not an organization usually lacking in a willingness to go on the offensive against its rivals), perhaps lacks the credibility to make any challenges to the EIHA position – because it is refusing to answer any questions at all about its own toxicology submission; and,

- the Advisors to the SAPPG are actually nothing more than stakeholders from the CTA, the CIC and – you’ve guessed it – EIHA itself.

What we ask is that EIHA are transparent and that the industry associations who claim to be the “voice of the industry” or “represent the industry” start doing just that, rather than remaining silent save for the renewed calls for their own membership fees – when you sell your soul to the Devil, you need to ensure that you get a good price for it.

Remember what we always say: Be Careful Who You Listen To.

APPLICATION OF THE CRITERIA TO ONLY COMPLIANT PRODUCT TYPES

THEORETICAL APPLICATION OF THE CRITERIA TO CURRENTLY NON-COMPLIANT PRODUCT TYPES